The Dreaded W-4P: How do I fill this out?

First of all, let’s define what we’re talking about, since many of you may not have filled out a W-4 for over 20 years. If you’ll think back when you got hired, you filled out an IRS form called W-4 “Employee’s Withholding Certificate”. This was what determined how much tax was going to be withheld from your check every pay period. Then at the end of the year, you hoped it would be enough and you wouldn’t owe additional money to Uncle Sam. Everyone remember that?

Like many things in life, this used to be simpler. Like, much simpler. You picked Married or Single, and the number of exemptions you were going to claim. For example, Single-0; or Married-4, etc. You guys are probably familiar with this. What you probably aren’t familiar with is that system no longer exists. With the Tax Cuts and Jobs Act of 2017 (TCJA), exemptions went away. In all likelihood, you don’t know this since there’s generally no reason for you to. But you don’t elect Married-2 or Single-0 anymore on your W-4. That went away starting in 2020. Many of you think you’ll retire and just continue with Married-0 or whatever. No you won’t.

Ugh, Chris—you’re being boring again! Why do I even care about tax stuff?

Good question. The reason you care is that you may have to fill out a W-4 when you retire to tell OPM how much to withhold from your retirement check. And it’s not easy anymore. And you’ll call me. And you’ll ask me how to fill it out. And I’ll have the same conversation for the 8th time that week about how you hate the new form, and you aren’t sure what to put. That’s why we should BOTH care about this article.

To reiterate, when you file your Standard Form 3107 Application for Immediate Retirement, you will reach Section H. (Inexplicably there are no page numbers on this form, but it’s on the 3rd page of the actual form itself, not including the instructions portion. OPM—can you be troubled enough to put page numbers on this thing????) Section H is entitled Payment Instructions. And it includes where you put your bank account information, like your routing number so you can actually receive money every month.

Another part of Section H is question 3b. “Do you want to have Federal Income Tax withheld at the rate currently being withheld from your Salary? Yes or No”. Here’s a potential problem I’ve identified. I’m not even sure “Yes” is an option anymore, as most agencies I know request you to fill out a new W-4 form to attach with your application. I think this is because the new withholding procedure is now in effect. There is also a note in this section that says if you do not submit a new W-4, then “withholding will be at rate for married with 3 exemptions.”

This statement is also in IRS Publication 721, which is the publication that deals with our pensions and TSP. So maybe the IRS can continue to withhold at the M-3 rate? But the exemptions don’t really exist anymore, so I’m not exactly sure if this is an actual option from a practical standpoint. Because if your agency requires you to fill out a new W-4, you won’t have the option of selecting M-3 since that option doesn’t exist now. Confused? Forget about that for now, and read on….

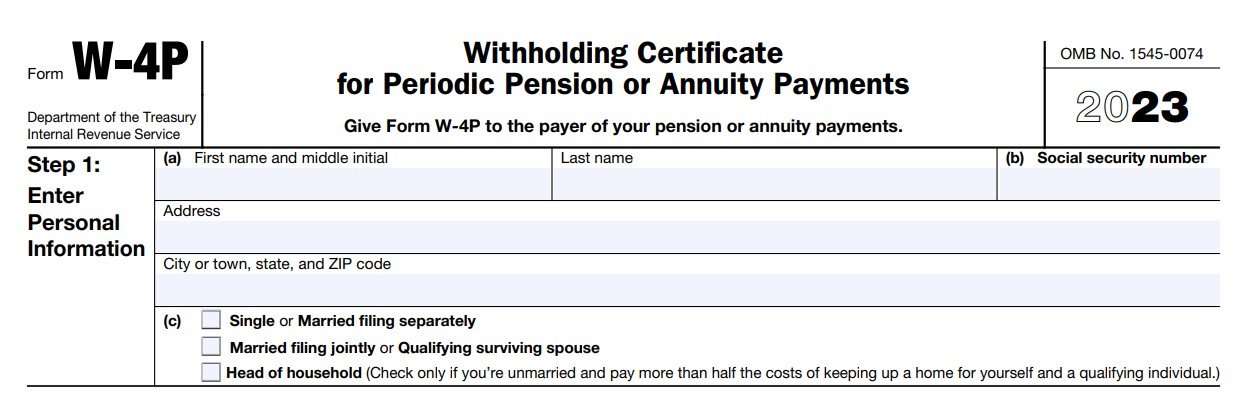

Bottom line? Be prepared to fill out a new W-4. To be precise, it’s actually a W-4P (as in “pension”). The title of the form is .“Withholding Certificate for Periodic Pension or Annuity Payments”. This is different than if you go to work somewhere. Then you’ll just fill out the standard W-4. So remember: W-4 for your job, W-4P for your pension.

Let’s walk through the W-4P (maybe print the form out and have it as you read through this?):

Step 1: Personal information.

This is self-explanatory. Name, address, and then Single, Married, etc.

That’s the last of the easy questions for a while. And, unfortunately, there are 4 more steps.

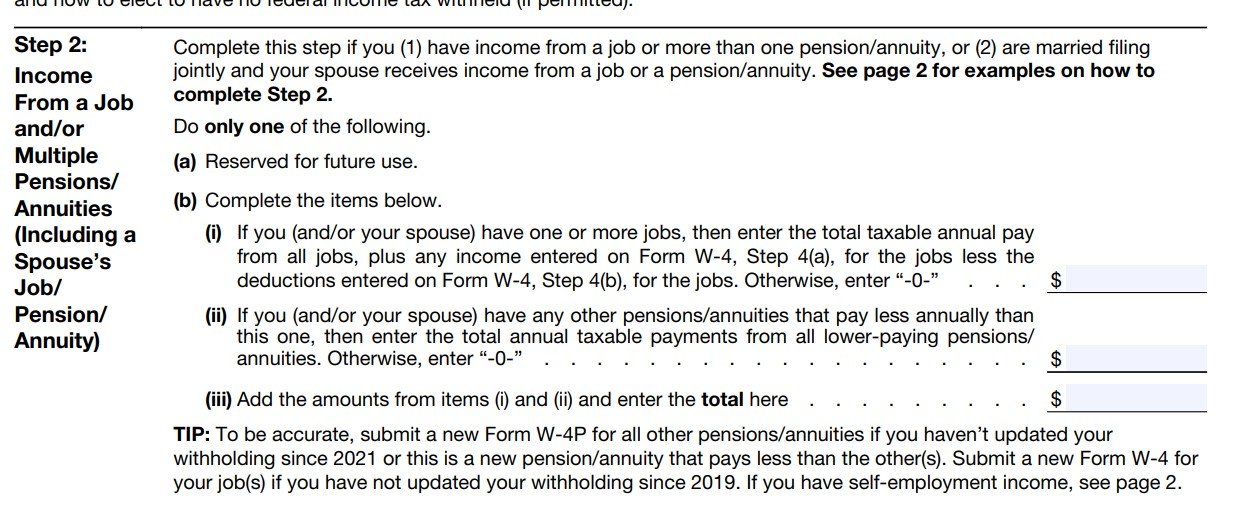

Step 2: Income from a Job (s) or other pension(s)

Bear with me. Take it line by line. And be patient.

Line (b)(i)

Not sure who writes this stuff, but I don’t think anyone’s going to ever accuse them of having an easy-to-understand writing style. Basically, what they are asking is “If you or your wife are going to have another job(s), add up how much you’ll both make together from all those jobs and put that amount on Line (b)(i).

Here’s an example.

Mike retires from the government. His FERS pension with supplement is estimated to be $70,000. Mike also got a post-government job that is expected to pay $100,000. Mike is also married to Jennifer, who makes $40,000 a year in her teaching job. In (b)(i), Mike will add up his next job and Jennifer’s job and put that amount ($140k) on that line. ($100k from his job, and $40k from Jennifer’s job). Mike will NOT put down his $70k pension anywhere on the form!

Another example.

Mike retires but is single and is not going to work anywhere else in retirement. Mike puts nothing down on Line (b)(i). Why? Because that is for jobs for him and his spouse. Since he’s not working, and he’s not married, he’s got nothing to put down. He just leaves that line blank.

Line (b)(ii)

This is NOT for jobs. This line is for OTHER PENSIONS. Meaning, not the pension for the person who is filling this out. But if maybe the person filling it out has another pension (like say he got vested in his NY state job prior to working for the federal government and will be receiving a pension from NY State?); or it could be if the person filling out the form is married to another government employee and that person is getting a pension.

Confused? I don’t blame you. Wish we went back to the Exemption-style form? Most people do.

Let’s do an example.

Chris and Charmaine retire from the federal government. They both have pensions. They both then go out and get a job in retirement. Let’s say Chris is filling out his W-4P.

On Line (b)(i), Chris is going to total the salary for his new job and Charmaine’s new job and enter on that line.

On Line (b)(ii), Chris is going to list Charmaine’s pension in this space since it is less than his. That is a criteria—that you only enter the smaller pension. The form makes that point clear.

Still, in no place is Chris going to list the amount of his own pension. That’s what this form is for. The IRS is going to know that already. What they don’t know are the other sources of income going to Chris and Charmaine. So that’s what the other lines are for—for the IRS to combine all the income and come up with the appropriate amount to withhold from his FERS pension.

Other examples are listed for you on Page 2 of the form.

Line (b)(iii)

Just total up the two lines before this one - (b)(i) and (b)(ii).

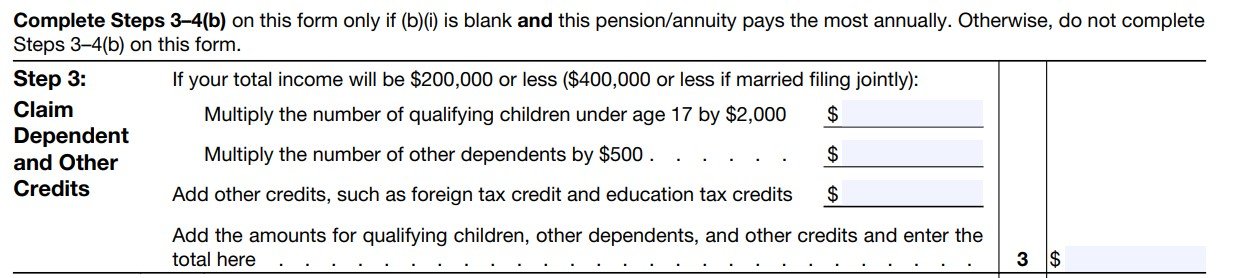

Step 3: Claim Dependent and Other Credits

If you filled out (b)(i) at all, you just leave this section blank.

If you didn’t fill out (b)(i), you can fill out Step 3. Hopefully what they want you to put down is pretty straight forward.

Step 4: Other adjustments (these are optional-no need to put anything in them)

Line 4(a) is if you have some income that comes in that you want taxes withheld that doesn’t normally have withholding. This would probably be more rare than the other questions.

Here’s a real-world example: I own a knife company and receive royalty checks each month for my knife designs. Those royalty checks can be quite large sometimes and no withholding is done from them. So I enter the estimated income for the year in this block. That way some of my pension check is covering the withholding for my knife income.

Some of you may have rental income from properties. You could list that income there as well. The form lists other examples such as interest, taxable social security, and dividends, that a person might want to put down here.

Line 4(b) is optional as well. If you are a person that does not take the standard deduction when you file your taxes, and you itemize like me, you could list your expected itemized deductions for the year. Or you could leave it blank even if you do itemize. I left mine blank, even though I itemize and don’t take the standard deduction. That was just one complicated step too far for me, personally, so I just left it blank.

Line 4(c) is the catch-all. If you got to the end of this form and you still want more federal tax to be withheld because you don’t think they’ll take out enough, then you can list the extra amount here. Unless you are super well-versed in this stuff, you’re probably getting the amount to put down from your CPA.

Section 5: Signing it. This is the only other easy section. Section 1 and 5 are manageable. Sections 2-4 are why CPA’s exist.

SUMMARY

Reading through this, you’re probably still very confused. I can appreciate that. I’ve done my absolute best to summarize and clarify the form. But there’s only so much I can do with this thing. You’re probably thinking, “I just won’t fill one out.” Again, I’m not sure that’s an option. Your agency may require to fill one out.

I know everyone likes to use TurboTax. It’s free (or at least cheap). People don’t want to spend a few hundred dollars with a CPA. I get it. But you get things with the CPA you don’t get with TurboTax, like a person that can sit down with you and help you fill out this form. Or even better, fill it out for you!

Here’s the danger of a DIY approach: you don’t complete the form with the proper information on it, and then the first time you go to file your taxes in retirement, you could find out you owe Uncle Sam $10k or more. This is why I stress with every single client I have to sit down with a CPA during the first year of retirement. Have them do a mid-year review of your taxes and withholdings to make sure you are having enough withheld across all sources of income. Why? To avoid that dreaded, unexpected tax bill the first year.

Depending on how you fill this form out, OPM MAY or MAY NOT be withholding enough to cover your pension. In my experience, most of you are in the 12% tax bracket if you are married and the pension is the only thing coming in. But, if you combine your pension with your next job, your spouse’s job, and maybe some withdrawals from the TSP, you may be in the 22%, 24%, 32% or even more. I know some of you are, because I’ve spoken with you.

If you don’t list that other income on your W-4P, you may not have enough taxes being withheld each month. That could prove problematic.

Again, I REALLY wish I could simplify this more. But it’s got so many moving parts and complications, I don’t know how to boil it down any simpler. But I’ll take a shot at a summary at least:

IRS Form W-4P may be required by a retiring FERS person

Line (b)(i) is for jobs in retirement, by either the retiree or their spouse

Line (b)(ii) is for other pensions in retirement, by either the retiree or their spouse

Do not fill out Step 3 if you put anything in Line (b)(i)

Step 4 is probably the least likely, but if you want to fine tune your withholdings, you can enter the most precise amounts you can come up with

Best practice by far is to have a CPA both help you fill out the form, and then help you with a mid-year withholding review to determine if you are having too much or too little withheld

NONE of this has anything to do with state income tax being withheld from your OPM check. That is a completely different process. And I’m not going to cover it here.

Guy, I know it’s tough. This is another reason why you start this stuff months and months before you retire, not the week before. It’s a lot to go through.

If you’ve never read one of my disclaimers, make sure you read this one!

Absolutely nothing in this article is to be construed as tax or legal advice. Don’t say, “chris told me to do [insert whatever you heard].”

I’ll fight to the death on that point. I’m trying to explain how the form works, not what you should put down. What I’ve suggested multiple times is that you sit down with a CPA to make sure you’re doing this correctly.

I’m not advising you on how to fill the form out for your situation. I don’t even know your situation. Understand you could be in a really, really bad mood the first April in retirement because you saved a few hundred dollars in CPA bills, but now you owe a few thousand to the IRS. I’m doing my best to encourage you to have a professional help you so you don’t run into that problem.

RESOURCES:

IRS Publication 721 “Tax Guide to U.S. Civil Service Retirement Benefits” (There is a section on withholding for FERS pensions and the W-4P).