The Supplement: All Your Questions Answered

If you’ll read the following, you’ll know more than 90% of the FERS employees out there regarding the supplement. Seriously. What is the supplement, how much will it be, how does it affect my Social Security, how do I apply, when will I lose it, etc., etc., etc., are all questions that are answered below.

Be warned: This is not the Cliff Notes version! This thing will be longer than a CVS receipt. But by including everything I can, my hope is that it becomes the definitive summary that everyone can keep coming back to. It’ll have a lot of stuff in it. A lot. Think of it as the Buc-ee’s of supplement articles.

I always try to give the authoritative literature for each of you to check things out. As I say often, don’t just blindly follow some internet whacko, even if that internet whacko is me. Verify everything. To that end, check out 5 USC 8421 and subpart E of part 842 of title 5, Code of Federal Regulations.

What is the real name?

First, we need to know what we are talking about so let’s start at the basics. The official name for the FERS Supplement is the Retiree Annuity Supplement. Where do we find this? Chapter 51 of the FERS Handbook.

What is it commonly (although incorrectly) called?

The Social Security Supplement

The Social Security Offset

The Social Security Stipend

The Bridge Payment

and maybe more that I can’t think of right now

For our purposes, I’ll refer to it by its proper name, its acronym (RAS), or simply “the supplement.”

Let’s get the Social Security thing out of the way up front. OPM pays the supplement. Social Security does not pay it. It doesn’t impact your Social Security in any way. So it is a bit misleading for people to refer to it as Social Security anything. It makes people think it in some way interacts with your Social Security when it does not.

What is it?

If a FERS employee retires under an immediate, unreduced annuity, prior to age 62, they are entitled to an extra payment each month in addition to their annuity. This extra payment is called the Retiree Annuity Supplement, or RAS. It really is that simple. There are some twists and turns in the plot. But it helps us to understand it in this context—it’s just an extra payment that we get for retiring before 62.

I was deliberate in saying it was for an immediate, unreduced retirement. The supplement is not available for those who take a deferred retirement, a postponed retirement, a disability retirement, or an MRA +10. If a Regular FERS employee takes a VERA, they will be eligible for the RAS but only after they have attained their MRA. For the vast majority of us, you can think of the supplement as arriving when you retire on a standard retirement, i.e., I’ve-done-my-years, I’m-old-enough, and-doggonit, I’m-retiring, type of retirement.

How do you apply for it?

You don’t. When you retire from FERS, you fill out an SF-3107 Application for Immediate Retirement. If you meet the requirements, you automatically get it once you start getting your retirement check from OPM. You don’t check an extra box saying you want the supplement. You can’t NOT take it. You can’t defer it to make it grow like Social Security. None of that. If you are eligible (see above), you will automatically start getting it.

When do you start getting it?

First, you have to be retired from FERS and collecting a FERS pension. You cannot get the supplement while you’re still working. So that is the first step.

Secondly, we have a divergence in the rules, here. So pay attention to what category you’re in.

FERS SPECIAL CATEGORY EMPLOYEE (SCE). When an SCE retires (LEO, Air Traffic Controller, or Firefighter), they are eligible to start receiving it immediately. Regardless of age. No need to hit a certain age threshold other than retirement itself. If you were eligible to retire, you are eligible to receive the supplement.

For example, an FBI agent retires at age 48 after doing 25 years of FERS SCE service. They would immediately begin receiving the supplement.

FERS REGULAR EMPLOYEE. When a Regular FERS employee retires, in almost all cases, they have to be at their MRA. There is a rule regarding the supplement for them that they cannot receive the supplement until they are at their MRA. For most Regular FERS, this isn’t an issue since they can’t retire until they are at their MRA anyway. However, as mentioned before, if you take a VERA, and you leave prior to your MRA, you will then have to wait until your MRA until you begin collecting the supplement.

In summary, SCEs get it when they retire, regardless of the age; Regular gets it at MRA. Both have to be retired first, though. Again, you can’t get the supplement pre-retirement.

When EXACTLY do you start getting it?

Not specific enough before? Ok, try this.

When you separate from your agency, your retirement process starts. Things go from your agency to your payroll processor and then to OPM. Once your packet gets to OPM (hard copy, paper packet, by the way!! Yes, even in 2023!), OPM first opens your file and places you in what is called “interim status”. This is when you are getting your partial (read: reduced) monthly check. You do NOT get the supplement while you are getting this interim check.

Once OPM spends a few months with the abacus, and goes through enough pencils, they will finalize, or “adjudicate” your retirement packet. At this point, they will pay you the money they have shorted you during the interim status. This will include your supplement amount. Then, moving forward each month, you will now start getting the supplement. It will come in the same deposit as your FERS annuity; there is not a separate deposit just for the supplement.

How much is it going to be?

If you have the type of temperament where your idea of fun is building one of those little ships in a bottle, you might enjoy trying your hand at the full calculation. Just visit the FERS Handbook, Chapter 51, pages 18-27. Yes, that's right--10 full pages of data for you to figure your monthly payment. And many pages of examples after that.

(This is THE formula. If you don’t use this, you are using an estimate. You are not using the actual formula that OPM uses. I can’t stress that enough. That is where the majority of your complaints come from. You use an estimate to calculate your supplement. Then when you have a different amount than OPM is paying you, you want to argue with OPM. If you use an estimate shortcut, you are not using the actual formula and you will not necessarily arrive at the exact amount OPM arrived at. Please keep this in mind!)

For the rest of us, there's a more sane option. Given the complexity of OPM's method, it's no surprise that we can use a relatively accurate shortcut calculation that has proven to be fairly accurate.

Take the number of whole years you worked under FERS. This is actual FERS creditable service time, not military time added. Divide that number by 40 and you'll get a percentage. Let's say you worked 25.5 years as a FERS LEO and you're retiring. That percentage would be 25/40=62.5% (Remember--whole years only).

Next, check out a recent Social Security benefits statement for yourself. These don't get mailed annually anymore so you'll have to go on ssa.gov and pull one off. On that benefit statement, you'll see your estimated monthly benefit when you are first eligible to file for SSA benefits at age 62. Multiply that monthly dollar amount by the earlier percentage and...boom! You just saved yourself 10 pages of frustration.

(And when you say your prayers tonight, be thankful you don't sit in a basement cave at OPM calculating supplement payments for a living.)

For example, let's say the monthly benefit estimate at age 62 is $1,800. We multiply $1,800 by 62.5% (25/40) and come up with a FERS Supplement monthly estimate of $1,125. This formula is meant to be accurate within $100 a month, and more often than not, it's a lot more accurate than that. You could expect to receive approximately $1,125 monthly from OPM in the form of Supplement payments.

Now, questions arise—Do I use sick leave in my estimate of number of years I worked in FERS? Remember—this is an estimate. This is not the formula. So use what you want in your estimate since OPM isn’t using this formula anyway. As a general rule, what I do any time I have the opportunity to estimate something, I take the more conservative approach. So when I am running these numbers for people, I do NOT include sick time in the FERS years. If there is a difference in what OPM ultimately pays, I want it to be higher than the estimate, not lower. I find that if someone’s budget works with the lower number, then their budget certainly works if their income comes in higher than expected.

Real World Example: Me.

I did 24 + years in the FERS system. Not counting any sick time. My estimate for Social Security at age 62 was $2,240, from my Social Security statement.

I did NOT include my sick time in my calculations. I estimated 24/40 x $2,240 = $1,344. That is what I estimated my RAS should be when I finally started getting paid for it monthly. $1,344 a month, or $16,128 annually.

My agency uses FedHR Navigator software for its own estimates. This is a common program many of you are probably familiar with (DEA, ATF, USMS, and many others use it). The agency estimated my monthly supplement to be $1,310 a month, using this software.

What did OPM ACTUALLY come up when they finally started paying me? $1,341.

My estimate: $1,344

Agency’s estimate: $1,310

OPM’s actual amount: $1,341

As you can see, all of these are close. None of them are more than $34 different from any other one. And that’s what the shortcut estimate is designed to do. Get you close (within $100) without doing the full monty. It got me within $3.

A note for you people whose agency uses GRB Software. This would be FBI, Secret Service, and others. For whatever reason, I have found the supplement estimate for GRB to be too low. In some cases, ridiculously low. I do not know the reason. I actually have no idea. But after seeing many of them, in my experience, the shortcut estimate we just talked about is more accurate than the GRB estimate. Use that for what it’s worth. If you do the shortcut method and it comes out near GRB, that’s a good sign—maybe your GRB estimate is more accurate than normal. If the GRB is $300 a month lower, your estimate is probably more accurate than GRB. If someone out there knows why this is, please let me know.

When does it stop?

Let’s deal with the easy cutoff point first. The month that you turn 62 will be the last month that you’ll be eligible for the supplement. You won’t be getting the supplement at age 63, for example. No one is. This is one of the reasons the nickname “the bridge payment” came to be. It bridges the gap between retirement and when you are eligible to file for Social Security at age 62.

So, it ends for EVERYONE the month they turn 62. No one is getting it past that.

However……..

It may stop sooner than 62, and this is the more complicated cutoff, so put on your thinking cap. This is OPM’s version of a Rube Goldberg contraption.

(Let’s take a little break for a second and discuss another characteristic of our retirement you all need to know. The Minimum Retirement Age, or MRA. Everyone has an MRA and it is based on your year of birth. For you SCEs, don’t get confused. This is not actually when you are able to retire. It means nothing to you about your retirement eligibility. For Regular FERS, it does. But for SCE FERS, it has everything to do with when your supplement becomes earnings tested. So if you don’t know your MRA, take 5 seconds, click on this link, find your MRA, then come back and continue on. And no, the earnings test is not always at 57. It is always at your MRA. Which may be 57, or it may not be. It all depends on the year you were born.)

Once a retiree hits their MRA, something happens. And for Regular FERS, you’re probably already there the second you retire, since you can’t retire prior to MRA, so this, in all likelihood, is ALWAYS going to apply to you. You SCEs are a little different. You may retire at 46 and your MRA is 57. So what we are talking about here does NOT happen until MRA. SCE—please read and re-read that statement. And read it again. Prior to you reaching your MRA, you do not have an earnings test. Earn $5m a year, and you’re still getting your $1,300 a month supplement.

Now go read it again.

However, when a FERS retiree reaches their MRA, the supplement becomes earnings tested. Meaning, to continue to receive the supplement from MRA to 62, you need to earn LESS than the threshold. If you earn MORE than the threshold limit, you will start to lose some, and maybe all, of your supplement.

So how does this work?

Once you reach your MRA (be that age 57, 56 and 10 months, or whatever), the clock starts ticking. Any earned income you generate will be counted toward the annual limit. From your MRA until 12/31 of that year, if you go over the limit, your supplement will be reduced the following year. Please note that anything in that year PRIOR to your MRA is good, and doesn’t count towards the earnings limit.

The earnings limit goes up a little bit each year. For 2023, it is $21,240. If two things are true: 1.) you are over your MRA, and 2.) you earn more than $21,240 in 2023, you’ll have your supplement reduced next year.

What is the exact procedure?

In the Spring of each year (~ May) in retirement, OPM will mail you a form. The form is RI 92-22. You will be required to file this form with OPM. This is how you report your earnings from the prior year to OPM. (It is also similar to how tax returns work if you think about it: You are reporting earnings from the previous year). If your earnings are over the limit for last year, then in July, OPM will reduce your supplement the proportional amount (read on for the exact formula.)

Let’s do a little example:

John was born on November 30th, 1966. John is a retired Secret Service agent who turned in his ear piece at 55. John’s MRA is 56 and 4 months. That means John hits his MRA on March 30, 2023 (That’s 56 and 4 months) John’s supplement is $16,000 a year, or $1,333 a month.

John retires at 55 and gets a job making $50k in the private sector. From 55 to 56 and 4 months, he’s got nothing to worry about. He gets his full supplement since he’s not at his MRA. However, he continues to work after hitting his MRA in 2023. Now anything he makes after this is earnings tested. Since John makes $50k a year, he makes $37,500 from April to December. (9/12ths of $50,000). Since the $37,500 he makes after his MRA is earnings tested, he has to file a form for OPM the following year (2024).

John fills out his RI 92-22 form and reports the $37,500 that he earned after hitting his MRA in 2023. OPM will look at this and say, ok, John earned $37,500, but he was only allowed to earn $21,240 before we ding his supplement. So how much did he earn over the limit? $37,500-$21,240 = $16,260. John earned $16,260 more than he was allowed to, so there is a penalty. The penalty is a reduction in the supplement. OPM says that for every $2 one earns over the earnings limit, $1 will be taken away from the supplement moving forward. Basically that means 50% ($1 is 50% of $2).

So in John’s case, 50% of $16,260 is $8,130. John’s supplement will be reduced from the $16,000 a year he is currently making to $7,870 ($16,000 - the $8,130 penalty = $7,870).

In July of 2024, John’s supplement will be reduced to $7,870 a year, or $656 a month. That begins in July of 2024.

The next year, the whole process starts over. In May of 2025, John will file OPM RI 92-22 and report his earnings for all of 2024. If he’s over, OPM does the calculation and makes it effective in July of 2024. If he’s NOT over the limit for 2024, then OPM will reinstate his full supplement in 2024 moving forward (eventually!). So as you can see, it’s not a permanent thing. It can be turned on and off, depending on the earnings from the previous year. But there is definitely a delay in turning them both off and back on, so keep that in mind. See below for exactly how difficult it is in reinstating it!

Let’s do another one:

Marcy is regular FERS and retires at age 57, her MRA. She retires on 10/31/23. She immediately gets a job paying $100k a year and starts 11/1/23. Marcy is retired and at her MRA, when will she lose the supplement? Well, remember, it’s a calendar year calculation. So as long as Marcy doesn’t make over $21,240 between 11/1/23 and 12/31/23, she didn’t go over this year. So in May of 2024, she won’t have to report that she’s over the limit for 2023. Meaning, OPM won’t reduce her supplement in July. Meaning, Marcy hit it just right and she will get the supplement for 2023, all of 2024, and then (assuming she’s still working) will finally have it reduced in July of 2025 after she reports her earnings in March of 2025. Make sense?

Next logical question….

What counts towards the earnings limit?

This is a good question because not all income counts towards the earnings limit. For example, any pension you receive (federal or state) does not count. Neither does investment income, inheritances, royalties, capital gains, rental income, unemployment, jury duty, scholarships, lottery, gifts, TSP withdrawals, or any money your spouse makes in any way. Really, what counts is earned income. Meaning you work somewhere for the money. Either as an employee (W-2 employee it is sometimes called), or as a contractor (often referred to as a 1099 employee), or self-employed, meaning you work for yourself.

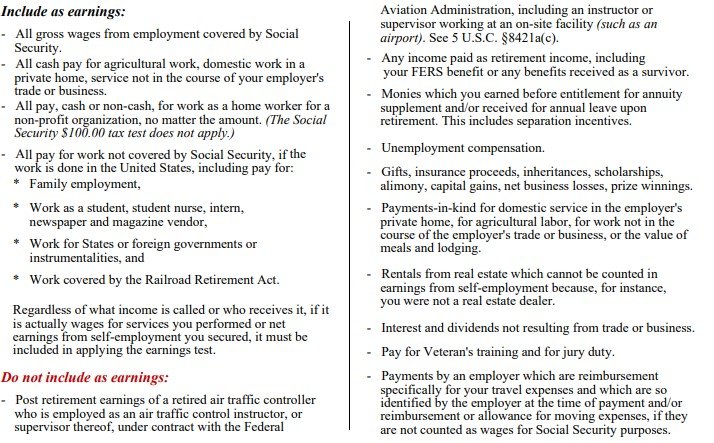

OPM uses this phrase, “…if it is actually wages for services you performed or net earnings from self-employment you secured, it must be included in applying the earnings test” (RI 92-22 Form).

Want to see EXACTLY what OPM says you should include and what you shouldn’t? Look no further than the RI 92-22 Form itself. Here is a snapshot:

Also, remember that it is income AFTER you retire. So if you have a part-time job on the side from January to June, then retire in June from the government, the money from your side hustle from January to June won’t count towards the earnings limit because you weren’t actually retired yet.

If I made too much, do I have to pay the supplement back?

In general, the answer is no. If you file your paperwork timely each year, then you are good to go. You will hear horror stories about people having to pay back tens of thousands of dollars of supplement payments. In every case I am aware of, those people did not file their form to report they earned over the limit. Eventually, even if you don’t report your earnings, OPM will find out about it. If you’ve been getting the supplement for years when you shouldn’t have, trust me, OPM will come for that money.

But if you file timely and report your earnings like you should, you should never have to pay anything back. They will simply reduce your supplement moving forward.

Any tips on if paying it back if I do have to?

In the comments section below, John found himself in this spot. He has a suggestion. Let OPM take it from your monthly deposit, rather than sending in a check for the overpayment. In his case, he mailed the check to DC, but OPM still took the overpayment back from his deposit as well. Meaning he paid it back twice, and then had to get the payment back from OPM.

Bottom line, let them withdraw it from your monthly retirement deposit each month.

How does it get reinstated?

Very slowly and painfully.

Chapter 51 of the FERS handbook is conspicuously silent on the exact procedure to turn the supplement back on if you stopped earning over the limit in retirement, but you aren’t 62 years of age yet. So I’m going to go to other sources.

The magnificent FERSGUIDE, by Dan Jamison states the following:

“Restarting the RAS can be a very time-consuming process that can take 8+ months with plenty of telephone calls and follow-up emails, and possibly a letter from your elected representative (I’ve seen it all). If you qualify, your RAS will eventually be restored, but be very patient.

What’s interesting about RAS reinstatement is that it is retroactive to January 1 of the year of reinstatement. This seems at odds with the July 1 effective date of reductions to the RAS, but I have reviewed the emails and letters received by my readers from OPM when the RAS is reinstated and confirmed the January 1 retroactive adjustment.” (SCE FERSGUIDE, 2023, p. 32).

Here’s what those that have actually gone through this have told me. First, it’s extremely frustrating, and extremely slow. Secondly, they get mixed information when they speak to OPM about exactly what they need to submit to “prove” they aren’t making over the limit anymore. Most of the times they are instructed to submit tax returns. But one retired DEA ASAC told me they required him to submit a recent SSA benefits statement in addition to tax returns.

Some people have reported waiting over a year. You can read some of the comments below for real world examples.

I agree that it is odd that the payment would be retroactive back to Jan 1 of the reinstatement year. When every other effective date for the “RAS year” is July?? But again, lack of detailed information in the FERS Handbook regarding reinstatement.

How much is the COLA on the supplement?

Trick question. There is NO COLA ON THE SUPPLEMENT! This is a persistent rumor out there. I’ve seen it in FERS articles, and heard it in FERS seminars. There is never a COLA on the supplement. If it’s $1,200 a month when you start getting it at age 50 (For you SCE’s), that’s the most it will ever be.

How is the supplement taxed?

Ordinary income. There is a myth out there, often times circulating with the COLA myth, that only part of the supplement is taxed. Sort of like Social Security. That is false. All of the supplement is taxed as ordinary income. Meaning, you pay taxes on it like regular income. There are no breaks like for Social Security, or capital gains, or dividends, etc. It’s just taxed straight as income.

How does the supplement affect Social Security?

It does not in any way affect your Social Security. It doesn’t matter if you get the supplement, don’t get the supplement, lose it, etc. None of those things impact your Social Security payments in any way.

What if I retire at 62 or later?

Then you will receive no supplement. The chance for a supplement ends at 62. However, you may be eligible for an additional .1% of your pension calculation. You’ll have to research that.

Is there a survivor benefit for the supplement like the annuity?

Kinda. Let me explain.

As a refresher, for your spousal survivor annuity options, you can elect a 5% reduction to provide your surviving spouse with 25% of your annuity for the remainder of their life. Or you can elect a 10% reduction in your annuity to provide your surviving spouse with 50% of your annuity for the remainder of their life. (Or you can elect 0%). The supplement survivor benefit works a little differently.

FERS Handbook, Chapter 71, Page 21 addresses this. The official term is “Spousal Annuity Supplement”.

To get part of the supplement as a surviving spouse, certain things have to already be true:

The surviving spouse is entitled to a survivor annuity (so the 25% or 50% mentioned above)

The surviving spouse is under age 60

Entitled to SSA survivor benefits based on the deceased spouse’s record when they will turn 60. Meaning, you are eligible to file for widow/widower SSA benefits at age 60. This would be the vast majority of you.

How much will it be?

I don’t know. And here’s why.

Lawmakers must have been in a bad mood when they wrote this procedure. It’s hard to follow. I’ll do my best. Two calculations are done:

An “assumed” CSRS survivor annuity, which basically means what the deceased would have received under CSRS. Yes, CSRS. Even though the deceased was a FERS employee. (And no, I can’t explain why).

A modified computation of the RAS.

Then, the surviving spouse is paid the lesser of:

The amount that Calculation 1 above exceeds the FERS survivor annuity, or

Calculation 2 above

Now, you can see why I say “I don’t know what the amount will be.” When I am counseling my clients, I generally advise them to not plan on any type of spousal annuity survivor benefit. One, because it’s virtually impossible for them to calculate, and two, it ends at 60 regardless. If they do get one, then it will simply be additional money that will help out. In other words, don’t count on it.

An astute reader—which you guys all are— will notice that it ends at 60 when the normal RAS ends at 62. You may ask why. One of the foundational rules of the RAS is that you cannot get it once you are eligible for SSA benefits. Most of the time, that is at 62. However, widows/widowers, are eligible to file for benefits at age 60. That’s just what Congress determined the age should be for this category of folks to help them out.

But the triggering effect that has on the survivor RAS is that it ends at 60 since you can’t be able to get a part of the RAS and also get SSA benefits. As OPM states on page 23, “The spousal annuity supplement terminates at the beginning of the month in which the spouse attains age 60.”

Is there anything else I should know about the supplement?

Probably. You guys enter your questions in the comments below and we can see if we need to address anything else. Though, I feel like this is pretty comprehensive as it stands, but maybe we can add to it.

With regards to deciding whether to retire from the government or not, a check in the “pro” column for leaving would be a longer time of getting the supplement. And a longer time getting it prior to MRA for you SCEs, meaning both the supplement AND additional outside income with no loss of the supplement. That can be a gamechanger for retirement planning.

Another real world example from Barfield Manor: My wife’s and my supplement together from retirement until MRA at 57 will total $225k. A quarter of a million bucks guaranteed by the government, along with outside income and no loss of supplement (at least until 57). If we don’t work over the limit past age 57, that’s a total of about $380k from retirement to age 62. Hard to leave all that money on the table and continue to work for the government. Your mileage may vary, however. Personal finance is very personal. So, you make the best decision for you and your family.

If you’ve made it this far, congrats are in order. It’s a lot. Hopefully this is a good reference that each of you can keep coming back to as you have a question. I will try to update this each year as the earnings test continues to increase.

Please share with others as we both know, there are tons of questions out there about this benefit.

ANNUAL LIMITS