TSP--Should I Stay or Should I Go?

10/18/22 Update: Some items have been changed due to the new TSP website, rules, and the passing of the Secure Act. Also fees have been updated to reflect the current costs. Every effort is made to stay current on these articles, but understand rules and laws are fluid. You should do your own research and verification.

12/31/22 UPDATE: SECURE ACT 2.0 GREATLY IMPACTS TSP AND RETIREMENT ACCOUNTS. INCLUDING SOME OF THE ITEMS IN THIS ARTICLE. PLEASE RESEARCH CURRENT LAWS BEFORE MAKING FINANCIAL DECISIONS.

Once you leave the government (either through retirement, or just plain walking away fed up), you have the option of moving your TSP to an IRA. Get on any TSP Facebook page, or financial forum and you’ll read no end to the number of opinions both for and against moving. My plan with this newsletter is to go a different way. In lieu of opinions, I’m going to offer facts. I know, I know…a novel concept these days.

My hope is that facts help you come up with your own opinion, rather than you just regurgitating other people’s opinions.

(I’ve actually written on this subject before, but it was more focused on deciding whether to transfer your TSP to an advisor or managed account. This newsletter will be just pros and cons of staying.)

First of all, what’s an IRA?

The IRS calls them an Individual Retirement Arrangement. Everyone else calls them an Individual Retirement Account. It is an account that has certain tax advantages. Anything that has a tax advantage also has some additional restrictions. So be careful. While you can draw money out of your checking account any time you want for any reason, your IRA may not allow that type of freedom, particularly if you are under 59 1/2.

But let’s be clear on one thing—an IRA is not an investment per se. It is an account that holds investments inside it. Just because you have a garage, doesn’t mean you have a car inside it. You could have nothing, or you could have a truck, a motorcycle, a lawnmower, or just a bunch of junk. The IRA works the same way. In your IRA, you can have mutual funds, stocks, bonds, options, or even good old cash that’s not invested in anything. For our purposes, we will be talking about moving TSP money out of the TSP and into an IRA. Once the money is in there, we’ll only be talking about investments that are very similar to what we have available to us in the TSP—like the C Fund for example. So if you’re hoping for some awesome real estate trust investment advice, or complicated option spreads, you’ll have to wait for a future paper.

Where do you get an IRA? You can get them at any number of brokerages, mutual fund companies, etc. The big ones I’ll mention in this paper are Charles Schwab, Fidelity, and Vanguard. But you can get them at ETrade, at T. Rowe Price, and dozens of other places.

What happens to your TSP when you leave the government?

Maybe nothing. But that’s up to you. Once you are separated from the government and TSP is notified, you will have the option (but certainly not the requirement) to move some (or all) of your TSP to an IRA. Traditional TSP has to go to a Traditional IRA. Roth TSP has to go to a Roth IRA. (Incidentally, before we go too far, understand that the Roth TSP to a Roth IRA is a one-way move. That money cannot come back into a Roth TSP. The Traditional side can move back and forth between TSP and IRA. The Roth cannot. Like your glory days on the court, once it’s gone, it’s gone for good.)

LEAVING THE TSP

Why might someone want to move money from TSP to an IRA?

More investments options. If you stay in the TSP, you’ll have the same funds you’ve always had available to you: G, F, C, S, I, and the L Funds, which are just combinations of those other funds. That’s it. If you want to buy Apple stock, or Coca-Cola bonds, or the Vanguard international fund you’ve been researching, you’re out of luck. The TSP doesn’t have those options. The IRA does, however. You literally have thousands of individual stocks, bonds, and other investments you can choose from in the IRA. 10/18/22 Update. The TSP now has the Mutual Fund Window (MFW). A TSP account holder can pay $150 a year for the opportunity to purchase any number of approximately 5,000 mutual funds in their TSP at approximately $28 per trade.

No RMD’s. This one applies only to the Roth TSP being moved to a Roth IRA. Some people want their money to stay in their account as long as possible. What really concerns them is taking it out one day and getting taxed on it. The IRS has a tool for forcing these people to take their money out so that taxes have to get paid, and Uncle Same can wet his beak. That tool is called Required Minimum Distributions (RMDs). Once an individual turns 72, they are required to take a minimum distribution from their account. (Hence the name). This grates on some people to no end. If this is a concern of yours, understand that Roth IRA’s do NOT have RMD’s. If you have a Roth TSP and are coming up on 72 years of age, you’ll have to start making withdrawals. If you don’t, you’ll be penalized. A lot. If you want to avoid the withdrawals and the penalties, you could transfer your Roth TSP to a Roth IRA and you successfully dodge both. This is Roth only. Traditional TSP and Traditional IRA’s don’t have this benefit. Talk to a financial planner first, please.

10/18/22 Update: Penalties will probably not apply to your TSP account. TSP rules state they will automatically distribute your RMD in the year it is required, Thus avoiding the penalties.

Professional investment advisor. Some people may want to turn all (or part) of their TSP money over to an investment advisor to manage it. To let him buy and sell lots of different things and make you lots of money (that’s the theory anyway). This isn’t really possible with the TSP. Yes, you could just give him your TSP username and password, and have him move funds around from time to time, but he’s not likely to go along with this. And you’re not really giving him anything to work with. He’ll prefer his basket of mutual funds and stocks he can buy for you.

Avoid a tax catastrophe, Part One. Bear with me here as this one might get a little confusing. But it’s super important for you to understand it. The consequences could be devastating. Let’s assume you are married and your spouse is the sole beneficiary on your TSP. 10 years into retirement, you kick the bucket. Your wife inherits the $500k left in your TSP. Because she was your spouse, TSP allows her to have her own TSP account. TSP calls these types of accounts Beneficiary Participant Accounts (BPAs). She can manage it however she wants. She can move money around the different funds, she can transfer it to an IRA, etc. Basically, she’s got the same ability you did. Now, let’s assume she passes away—maybe she crashed the Ferrari she just bought with part of your TSP. Next in line is your child. Here’s the bad part: The child CANNOT get their own TSP account. Furthermore, the child CANNOT get an inherited IRA. The only thing the child can do is get a big fat check from the TSP for the entire remaining balance. The…whole…thing. Imagine the taxes? They may pay so much, they’ll get a Christmas card from the IRS that year.

Let’s recap this to make sure you get it. Spouses can inherit a TSP and keep it there. Once a spouse dies with that TSP, they will cash them out, and provide the beneficiary with a smaller check but a larger 1099.

What to do to avoid this? The original owner of the TSP (you in this example) or the spouse, can transfer the money from the TSP (or TSP BPA) into an IRA. This is squarely in the wheelhouse of estate planners. If you want to know more about this and how to avoid devastating your lifetime of savings, please, please speak to an estate planner. These rules are tricky. And the mistakes are costly.

Avoid a tax catastrophe, Part Two. This one is similar to the above. But we are not talking about spousal beneficiaries. Say you are single. Or just say you don’t want to leave your spouse anything, and the beneficiary is just a friend. Same scenario—you’re dead. TSP will NOT set up a BPA for that person. Those are only available for spouses.

But, the TSP also won’t require you wipe the money out right away. In this situation, you can set up an Inherited IRA, and pull the money out over a period of years. You’ll still have a hefty tax bill, but it can be spread out and lessened over time, rather than getting killed in one year. Again, the estate planner is your friend here.

If you want to read about it directly from the TSP, try this link. However, be warned: That pamphlet was written in Jan of 2019. And the SECURE ACT dramatically changed the rules for Inherited IRA’s. So seek some professional planning advice in this area. It’s beyond the scope of this newsletter.

Increased Withdrawal Options, Part One. The TSP has made some strides since their comically inadequate “one lump sum withdrawal for life” position. (Seriously, that was ridiculous.) But there are still limitations to withdrawals from the TSP that don’t exist for the most part in the IRA world. TSP allows monthly, quarterly, or annually withdrawals. That’s better than before. In addition to these, you are also allowed to take one lump sum withdrawal per 30 days. That may be a bit inflexible for you. If so, the IRA is your friend.

Increased Withdrawal Options, Part Two. This is a HUGE complaint I hear all the time from TSP participants. Let’s say you are 40% G Fund, 30% C Fund and 30% S Fund. Let’s also say that the market just crashed again so your C and S are down. Maybe they are down a LOT. But you need some money to fix the roof. You want to withdraw only from the G Fund. You don’t want to sell your stock funds when they are down. After all, that’s why you put a lot of your money in the G Fund—to protect some short term withdrawals.

Sorry. No can do. TSP does not allow you to only withdraw from a particular fund. You want $10k? They will not ask you where you want it from, and if you try to tell them, they won’t care. You will will get $4k from G, $3k from C and $3k from S. And you’ll like it, sir.

You won’t have this issue in an IRA. You can sell whatever you want, or sell nothing at all. If you have cash in your IRA, you can just pull from that portion of the account.

Less inconvenience on withdrawals. This is a rule that applies to more than just the TSP, so TSP really can’t change this. But it does not apply to IRAs. If you want to make a withdrawal, or increase the amount of withdrawals you have coming out of your TSP, you’ll have to get your spouse’s signature and have it notarized. Retirees report this to be a pain, particularly if they have a spouse that is homebound, or simply doesn’t want to deal with this all of the time. COVID loosened up this requirement a little bit but it’ll go back.

You typically don’t have this 2 spouse consent deal with an IRA.

10/18/22 UPDATE: the spousal consent no longer has to be notarized. it still has to be approved by the spouse but it is electronic and no notarization is needed.

Fees. I can hear you now, “Wait Chris—you put this one in the wrong section. Low fees are why you want to KEEP your money in the TSP, not move them to an IRA. Everyone knows that!” Frankly, that may or may not be the case. So the “Fees” argument actually goes in both sections.

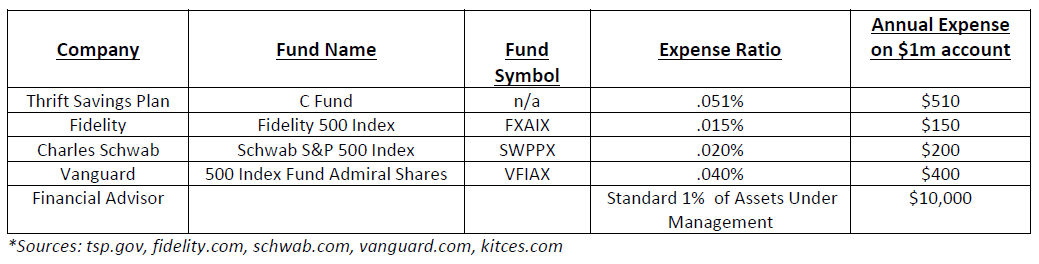

Yes, it is true, that for decades, TSP had some of the lowest, if not the lowest fees around. However, the financial world has been getting cheaper for decades now. Read my article on how we are actually in the good old days of investing. Let’s say you want an S & P 500 Index mutual fund in your IRA. (In case you didn’t know, that is the C Fund. Inside the TSP, it’s called the C Fund. Outside the TSP, it is the S&P 500 fund, although each company has a unique name for their version. But they are essentially the same.) If you wanted to buy the IRA equivalent of the C Fund from some of the biggest three names in the business: Charles Schwab, Fidelity, or Vanguard, all 3 would have cheaper fees (or expense ratios) than the TSP.

10/18/22 Update: Fees per TSP.gov, Fidelity.com, Schwab.com and Vanguard.com are currently: TSP C Fund .043%; FXAIX .015%; SWPPX .020%; VFIAX .040%

10. No contributions. This may bother some more than others, but once you separate from the government, you can’t continue to make contributions to the TSP. Yes, you may roll an IRA into a TSP and contribute to it that way, but you cannot make bi-weekly or monthly contributions from your salary at say, Walmart. You can make contributions to your IRA if you are working in retirement. There are some tax rules and limits related to that, but in general it can be done.

11. Faster withdrawals. TSP has to process your withdrawal requests. This can take up to 10 days after they receive it. So, think of the process here: You fill out the form. You get your spouse to go with you to a notary. You both sign it, and submit it to the TSP. Once they get it, they will process it and send you your money within 10 days. Friends, that sounds a lot like how business was done in the 1970’s. The IRA will be an online request you make on their website. And the money goes to your bank account. You know, like the 2000’s.

10/18/22 Update: As stated previously, notarization is no longer required. All other parts remain the same.

STAYING IN THE TSP

Ok, what are some reasons a person might stay with the TSP instead of moving money to an IRA?

Earlier withdrawals. This is a huge benefit. Special Category Employees (these are feds that tote guns or hoses, or tell planes when they can land) can withdraw from the TSP penalty-free if they retire in the year they turn 50 or later. That’s huge.

My wife is an FBI agent. She will retire next year when she’s 49. If she wants to (and I really hope she does) withdraw $100k from her TSP and buy me a Range Rover, she can do that without paying a penalty for an early withdrawal.

If you are Regular FERS and not an SCE, the same rule applies to you but the age is 55 instead of 50.

However, and this is a key point. Those are TSP regulations (actually they are IRS regulations but they include the TSP). If you move money from the TSP over to an IRA, you are now under IRA rules, not TSP rules. And you no longer have an exception. You are like everyone else—you have to wait until 59 1/2 to withdraw your money penalty free. The early age exceptions don’t follow the employee, or their money, to the new account. Sorry.

There are some ways to get around this penalty for early withdrawals in the IRA. But they are complicated, and greatly reduce your options. You want to research 72t rules. Or better yet, speak to a financial planner—there are serious drawbacks to going down this road.

Remember though—you can transfer Traditional IRA money back into the TSP (don’t close your TSP account!!). Once it’s back in there, it’s under TSP rules and you can withdraw it penalty-free before 59 1/2.

As you can see, this may be a huge benefit for those retiring younger. However, once you are 60 years old, this benefit is negated by time, so it’s a benefit to staying with the TSP for sure. But it has a shelf life.

Security. This may be less fact than opinion, so I offer that caveat up front. Big investment firms and other IRA custodians are heavily regulated and for the most part, very financially sound. However, they do not have the authority to print U.S. currency and make laws. So while they are secure, they are probably not as secure as the G Fund which is backed by the full faith and credit of the United States. If you want to argue that the U.S. may have trouble honoring its debts in the future (I hear this a lot), I won’t dispute it. I’ll let you make your decision accordingly.

Understand a unique quirk—the TSP is not guaranteed against fraud. If someone defrauds you and wipes your account out, you won’t necessarily see that replaced by the government. That being said, I have seen fraud committed in the TSP and even though the money was not recovered, the TSP made that person whole. But it is my understanding they are under no legal obligation to do so.

Protection of Assets. I hope this never applies to anyone reading this. But the TSP is legally a trust. As such, it offers additional legal protection if you are being sued. More so than a private investment account. I am not an attorney so I won’t elaborate more on this. If this is a concern of yours, please see an attorney regarding issues related to this.

The G Fund. The G Fund is unique. I realize it made less than 1% last year. It will make more than that this year, I’m almost certain. Inflation is rising. (Did you know that in the late 80’s and early 90’s, the G Fund averaged almost 9% a year???) Regardless, it is the only TSP fund we have access to that is not available anywhere else. If you want to buy the F, C, S, or I Funds, or rather their equivalents, you can get those any time you want in the private sector. Open an account with Schwab or Fidelity and you can buy all of those the first day. Not so with the G Fund.

The G Fund consists of specially issued government bonds that have 100% liquidity, guaranteed no loss of principal, and an interest rate much higher than short term bonds. This fund is unique in the investment world. Buy government treasuries in the real world, and you can lose money on them. Buy them inside the TSP, and you never will. So in this case…advantage TSP.

Fees. Yes, we’re back on this one. TSP may or may not have lower fees. We’ve discussed that. If you move into an actively managed mutual fund, it will probably be more expensive than the TSP. However, that might not be a fair comparison, since we don’t have any actively managed funds available to us in the TSP.

If you are thinking about moving your TSP to an investment advisor that charges you a percentage of assets under management (AUM), the TSP will definitely be cheaper. The average fee for these advisors is 1% of your balance. That may be on top of the expense related to the investment they put you in.

Will it be worth it? Maybe. If they can consistently make you more than the 1% they charge you on top of what you can make on your own, well that might be just the ticket. I know of advisors that do just that. They make retired Feds WAY more money than they could make on their own, including the 1% AUM fee. I’m not advising one way or the other. Just do your homework.

“So, Chris, what are you saying? Should I leave the TSP?”

Frankly, I don’t really care what you do. I’m not trying to get you to move or stay. This isn’t an advice column. (Although “Dear Chris” seems like it might be an interesting project…) However, I do think that there are probably some better-decisions vs some-not-so-good decisions. Let’s go through some of them:

Don’t close your TSP account. If you read my papers, you know I rarely say anything dogmatic in the financial sense across the board. Everyone is in a different place. But this comes as close to a blanket statement as anything I’ll ever say. Once you close that TSP account, you cannot get back in. Ever. You only need $200 in your TSP to keep it open, so that seems like a no brainer. I actually recommend maybe keeping a couple of thousand in there and all in the G Fund. I don’t care how fantastic that IRA is, or that advisor is, or that special Toledo, Ohio Time Share Real Estate Trust is, things can go sour and you want the ability to get back into the TSP.

If you’re younger than 59.5, there is definitely an advantage to having at least withdrawal money in the TSP. Yes, I’ve seen advisors talk 50 year olds into transferring everything, and setting them up on 72t payments. And maybe they are happy with that, but all else being equal, I think it’s preferable to have more options as opposed to less options.

If you’re much older, and are concerned about RMD’s, a Roth IRA certainly has an advantage over the Roth TSP. But get some advice from a financial planner to structure everything correctly.

The G Fund is probably the highest paying “money market” account you’ll ever find. I know it’s not technically a money market account, but it acts substantially like one for our purposes. That may factor in as an important piece of your financial puzzle.

If you’ve already lost a spouse and have their TSP, you might want to speak with an estate planner right away. That tax consequence upon your death could take far more money than it should.

You have flexibility. And you have control. And you have time. Don’t be pressured into doing something you don’t fully understand or don’t want to do. And don’t just copy me, or anyone else. The day I tell y’all I know what the market is going to do is the day you should all unsubscribe!

Come up with your own game plan that’s right for you and your goals. This whole investing thing isn’t a competition. How someone else’s account performs has absolutely zero impact on your account.

If you are planning on instituting some sort of plan that involves transfers to and/or from the TSP, you really need to speak with someone that has solid financial credentials and has a lot of experience with this. We didn’t talk about a lot of the potential tax consequences here if someone makes a misstep. This isn’t the time to cheap out.

Lastly, I always try to be as transparent as possible. And I like to try to avoid the 8 dozen, “Chris what are you going to do with your TSP?” emails. Actually, come to think of it, since I’m trying to avoid all the emails, maybe it’s more laziness than transparency. Regardless, I am going to transfer some of my TSP out to an IRA and keep some in the G Fund. I am planning on adopting the Barbell Strategy I’ve written about so much over the last year or so. This will entail me transferring my C Fund portion (70%) to my Schwab IRA, and leaving the 30% G Fund inside the TSP. For what that is worth. And again, do what’s best for you. I’m not recruiting any followers here.